Which Schedule Se Form Did You Use in 2019

Calculate Stews self-employment tax for 2019 using Schedule SE. SCHEDULE SE Self-Employment Tax 2019.

How To Fill Out Your 2021 Schedule C With Example

Most self-employed people will mark that its.

. SCHEDULE SE Form 1040 or 1040-SR OMB No. His Schedule C net income is 167200 for the year. Enter the amount on Line 13 on Schedule 1 Form 1040 Line 1 to claim the deduction for one-half of the self-employment tax.

We figure out your self. Schedule SE is generally required if you file Schedule C-EZ Schedule C Schedule F or Schedule K-1 Form 1065. Multiply line 12 by 50 050.

Enter here and on Schedule 1 Form 1040 line 14 13 Part II Optional Methods To Figure Net Earnings see instructions Farm Optional Method. Did you report any wages on Form 8919 Uncollected Social Security and Medicare Tax on Wages. They did not make more than 117000.

You use it to calculate your total self-employment tax which you must report on another schedule of Form 1040 Schedule 4 line 57. Nonresident Alien Income Tax. Schedule SE on Form 1040.

They did not receive tips that were unreported since all were reported through the 1099-K They did not. Form 1040-NR US. If you did take a loss youll need to let the IRS know if you are personally at risk of losing all the money if the business fails or if theres outside investment preventing you from actually losing all the money.

Enter the result here and on Schedule 1 Form Did you receive wages or tips in 2019. Other Federal Individual Income Tax Forms. You must use Long Schedule SE on page 2 Section AShort Schedule SE.

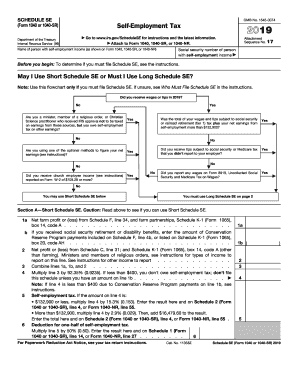

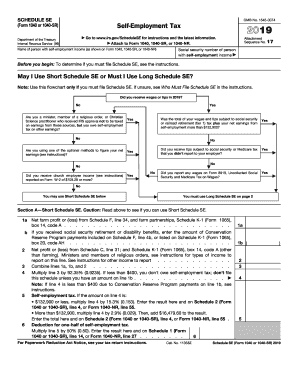

Im trying to get the same deduction for his 2019 self employment tax but I dont see any place where it shows the deduction. Individuals use IRS Schedule SE to figure out how much self-employment tax they owe. May I Use Short Schedule SE or Must I Use Long Schedule SE Note Use this from ACCOUNTING 15 at Los Angeles Pierce College.

Schedule SE is one of many schedules of Form 1040 the form you use to file your individual income tax return. Schedule SE is used to calculate both your self-employment tax due and your one-half self-employment tax deduction on IRS Form 1040 and Form 1040NR. This tax applies no matter how old you are and even if you are already getting social security or Medicare benefits.

2019 Instructions for Schedule SESelf-Employment Tax Use Schedule SE Form 1040 or 1040-SR to figure the tax due on net earnings from self-employment. He also has a part-time job and earns 10032 in wages subject to FICA taxes. Attach to Form 1040 1040-SR or 1040-NR.

1545-0074 Self-Employment Tax Department of the Treasury Internal. If you made at least 400 in profits from self-employment or if Schedule SE is otherwise required for example church employee income well automatically fill it out and attach it to your return. View 2019 Schedule SE Form 1040 or 1040-SRpdf from ACC TAXATION at Olivet College.

All filers of Schedule SE will use the method of calculating self-employment tax found in Section B. Youll enter the Schedule SE calculations on IRS Form 10401040-SR in two places. SCHEDULE SE Form 1040 or 1040-SR OMB No.

1545-0074 Self-Employment Tax Department of the Treasury Internal Revenue Service. If you arent the spouse who carried on the business and you had no other income subject to SE tax enter Exempt community income on Schedule 2 Form 1040 line 4. Go to wwwirsgovScheduleSE for instructions and the latest information.

In addition to information. If you are self-employed and had net earnings from self-employment totaling more than 400. Enter the amount from Line 12 on Schedule 2 Form 1040 Line 4 to include the amount of self-employment tax you owe.

Net farm profit or loss from Schedule F line 34 and farm partnerships Schedule K-1 Form. Once all is said and done youll put this number onto your Schedule 1 Form 1040 on Line 12 and on your Schedule SE on Line 2. Form 1040 Schedule SE is the form used by taxpayers to figure the amount owed in self-employment tax.

The Social Security Administration uses the information from Schedule SE to figure your benefits under the social security program. An example for an Uber driver who made 50000 and had no other income. Are you a minister member of a religious order or Christian Science practitioner who received IRS.

If required round amounts to the nearest dollar. You may use Short Schedule SE below You must use Long Schedule SE on page 2 OMB No. 1545-0074 Department of the Treasury Attachment Internal Revenue Service 99 Sequence No.

You can not file Schedule SE with one of the shorter IRS forms such as Form 1040A. Include on Schedule SE line 1a or 2 the net profit or loss from Schedules C or F allocated to. Read above to see if you can use Short Schedule SE.

Schedule 2 Form 1040 line 4 12 13 Deduction for one-half of self-employment tax. You may use this method only if a your gross farm income 1. I found the Schedule SE form online and it shows that there is still a half.

As a result Schedule SE will also no longer allow joint return filers to use a single Schedule SE one using Section A and one using Section B. View Wills Schedule SEpdf from ACC 3410 at Northeastern University. Each taxpayer with taxable net self-employment earnings will use a separate Schedule SE.

Schedule SE calculates the Social Security and Medicare tax self-employment tax on profits from self-employment and certain other income. Dont file Schedule SE. We last updated Federal 1040 Schedule SE in January 2022 from the Federal Internal Revenue Service.

Stew Beauf is a self-employed surfboard-maker in 2019. This form is for income earned in tax year 2021 with tax returns due in April 2022. They received wages so follow the yes path to start.

On our 2018 federal tax return my husband got a deduction for one-half of his self employment tax. Use Schedule SE Form 1040 to figure the tax due on net earnings from self-employment. The Social Security Administration uses the information from Schedule SE to figure your benefits under the social security program.

Schedule C-EZ Form 1040 Net Profit from Business Sole Proprietorship Schedule C will be used Form 2555-EZ Foreign Earned Income Exclusion Form 2555 will be used Form 8965 Health Coverage Exemptions no longer applicable to tax years after 2018 IRS has also announced that Form 1099-H Health Coverage Tax Credit HCTC Advance Payments. But if you have 400 or more of other earnings subject to SE tax you must file Schedule SE. Enter all amounts as positive numbers.

SCHEDULE SE Form 1040 or 1040-SR Department of the Treasury Internal Revenue Service 99 Self-Employment Tax. We will update this page with a new version of the form for 2023 as soon as it is made available by the Federal government. Determine if you can use the short Schedule SE First follow this chart from the Schedule SE.

Schedule Se A Simple Guide To Filing The Self Employment Tax Form Bench Accounting

Fillable Form 1040 Schedule C 2019 Irs Tax Forms Tax Forms Credit Card Statement

How To Fill Out Your 2021 Schedule C With Example

Self Employed Declaration Letter Fill Online Printable Fillable Blank Pdffiller

0 Response to "Which Schedule Se Form Did You Use in 2019"

Post a Comment